Abstract

This paper explores the strategic role of personal significance in fostering enduring sales resilience among bankers in a rapidly evolving financial landscape. Moving beyond transactional models, it positions bankers as proactive value advisers whose resilience stems from a deep sense of purpose and belief in their professional impact. The authors identify five interrelated elements—sense-making, locus of control, relevance, self-efficacy, and flow—as foundational to personal significance. These elements collectively empower bankers to reframe setbacks, maintain motivation, and engage meaningfully with clients. The paper argues that cultivating personal significance is not merely a human resources initiative but a strategic imperative for sustainable performance, reduced burnout, and enhanced client relationships. Organisational culture, leadership, and infrastructure play critical roles in enabling this transformation.

Key Words: Personal Significance; Sales Resilience; Sense-making; Self-efficacy; Locus of Control

Introduction: The Strategic Imperative of Personal Significance in Modern Banking

The contemporary banking landscape is undergoing a profound transformation, moving beyond traditional transactional models to embrace proactive, value-based client engagement. This paradigm shift necessitates a re-evaluation of the banker's role, elevating it from a mere service provider to a strategic value adviser who initiates conversations and triggers client need awareness based on sophisticated data and contextual understanding.

Within this evolving environment, the concept of personal significance emerges as a critical determinant of sales resilience, defined not merely as the ability to "bounce back" from setbacks but as the steadfast maintenance of belief in the inherent value of one's work, even in the absence of immediate affirmation.

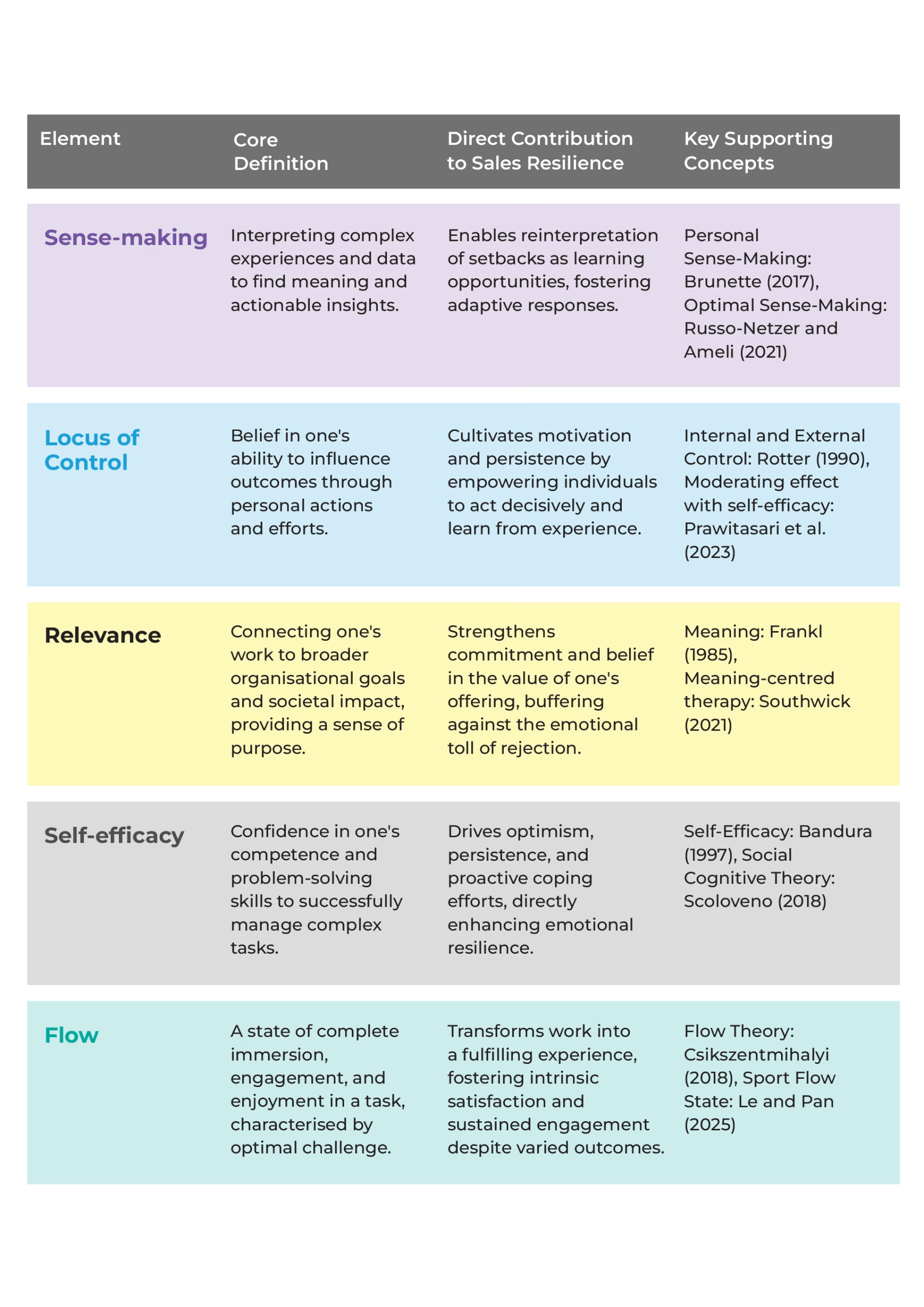

Personal significance, in the context of a banker's professional identity, represents an individual's conviction in their role as a vital change agent and the indispensable link in the balanced exchange of value between clients and the financial institution. This conviction encompasses both the 'human being'—the banker's mindset, self-perception, and foundational knowledge of the banker—and the 'human doing'—the tangible actions and techniques deployed to deliver solutions. This integrated perspective allows bankers to transform challenges into opportunities, thereby enhancing both client outcomes and organisational success. As articulated by Brunette and Viljoen (2018), Personal Significance is characterised by an individual's confidence in their ability to perform a specific task with the expectation of achieving a desired result, imbuing their contributions with energy, motivation, and profound meaning. It is understood as a composite experience, integrating elements such as sense-making, consciousness, self-efficacy, locus of control, relevance, and personal flow (Brunette, 2017).

The Five Elements of Personal Significance

Key Research Findings

Sense-making and Resilience

Resilience is significantly bolstered by what is termed "optimal sense-making," an integrated conceptual framework that synthesises rationality, drawing from Rational Emotive Behaviour Therapy, with the pursuit of meaning, as explored in Logotherapy (Russo-Netzer & Ameli, 2021). This intentional cognitive process enables individuals to evaluate adversity through both logical and purposeful lenses, thereby motivating decisions and actions that are optimally aligned with both reason and deeply held personal values.

For a banker experiencing a client rejection, this translates into the capacity to reframe the experience by asking, "What does this signify within the broader context of the value proposition being offered?" Rather than succumbing to self-doubt, resilient bankers connect the rejection to the broader value they represent, perceiving it as an opportunity for learning and adaptation rather than a definitive personal failure. This approach cultivates perseverance, mitigates distress, enhances resilience, and facilitates post-traumatic growth by encouraging acceptance and self-transcendence (Russo-Netzer & Ameli, 2021).

Locus of Control and Resilience

Locus of control refers to an individual's fundamental belief concerning the extent to which they perceive themselves as being able to influence outcomes in their lives (Rotter, 1966). Bankers who possess a strong internal locus of control are convinced that their own actions and efforts are the primary determinants of success or failure, rather than attributing these outcomes to external forces such as market volatility or organisational constraints.

Research indicates a crucial synergistic relationship between locus of control and self-efficacy in promoting resilience. While self-efficacy, or the belief in one's abilities, may not independently predict academic resilience, an internal locus of control significantly moderates and strengthens the effect of self-efficacy on resilience (Prawitasari et al., 2023). This implies that the impact of confidence in one's skills on resilience is amplified when an individual also believes they possess the agency to influence the environment sufficiently to apply those abilities effectively.

Relevance and Resilience

Relevance, as a component of personal significance, involves a banker's ability to connect their daily professional activities to broader organisational objectives and their wider societal impact. This connection might manifest, for instance, in understanding how assisting clients in achieving their financial aspirations contributes directly to economic growth and stability. Viktor Frankl's (1985) logotherapy, a school of thought rooted in existential analysis, posits that the fundamental motivation for human behaviour is the inherent desire to seek meaning and purpose in life – a pursuit that is demonstrably and strongly associated with enhanced resilience (Southwick et al., 2021).

A strong sense of relevance acts as a powerful buffer against the emotional impact of professional setbacks. When bankers are firmly convinced that their offerings are relevant and genuinely aligned with authentic client needs, instances of rejection do not define their self-worth or diminish their commitment to the work. Research consistently demonstrates that a pre-existing sense of meaning in life significantly predicts an individual's resilience and mental well-being during times of crisis, indicating that a purposeful life actively builds protective psychological factors (Arslan & Yildirim, 2021).

Self-efficacy and Resilience

Self-efficacy, a construct extensively developed by Albert Bandura (1997) within his social cognitive theory, pertains to a banker's belief in their inherent capability to successfully execute complex tasks, such as providing expert advice on diverse financial products or adeptly navigating intricate regulatory frameworks. This robust belief system actively triggers positive affective, motivational, and behavioural mechanisms, positioning self-efficacy as a crucial personal factor that enables individuals to effectively cope with a wide spectrum of stressors (Baluszek et al., 2023).

Empirical research consistently demonstrates that self-efficacy is a significant predictor of resilience; individuals exhibiting high self-efficacy are markedly more resilient when confronted with challenges and are more prone to achieving success (Kiliç et al., 2024). This psychological resource serves as a protective factor for mental health by significantly reducing general distress and is considered pivotal in mitigating the development of mental health problems (Cassaretto et al., 2024).

Self-efficacy stands out as a highly modifiable cornerstone of resilience. Unlike some psychological attributes that may appear more innate, self-efficacy is explicitly described as something that can be actively built and strengthened (Baluszek et al., 2023). The four established sources of self-efficacy – mastery experiences (successful performance), vicarious experiences (observing others' success), verbal persuasion (encouragement), and physiological and affective states (managing emotional arousal) – provide a clear framework for targeted interventions.

Flow and Resilience

Flow is a psychological state characterised by complete immersion and creative engagement in an activity, where an individual is performing at an optimal level of challenge and skill (Nakamura & Csikszentmihalyi, 2014). For bankers, this state might manifest when they are deeply engrossed in solving a complex financial problem, meticulously designing a tailored financial package for a client, or developing innovative approaches to customer engagement.

Experiencing flow profoundly transforms work from a mere transactional activity into a deeply fulfilling endeavour, enabling bankers to derive satisfaction from the process itself, even when immediate outcomes may vary. Empirical evidence reveals a significant correlation between the flow state and psychological resilience; athletes, for instance, who demonstrate higher levels of resilience tend to experience flow more frequently (Johnson & Carson, 2025). Moreover, psychological resilience plays a mediating role in the relationship between an individual's mood and their ability to enter a flow state. This means that resilient individuals are better equipped to regulate their emotional state, allowing them to initiate and sustain flow, even in stressful or challenging situations (Li & Pan, 2025).

The concept of flow suggests a proactive strategy for cultivating resilience, rather than merely being a performance outcome. If bankers can find deep fulfilment in the process of client engagement and problem-solving, irrespective of whether a sale concludes immediately, it provides an internal buffer against the demoralisation that can arise from outcome-dependent self-worth.

Discussion

The analysis presented underscores that personal significance is a multifaceted construct, where its five constituent elements – sense-making, locus of control, relevance, self-efficacy, and flow – are deeply interconnected and mutually reinforcing. The overarching impact of a cultivated sense of personal significance on a banker's professional journey is transformative. It enables individuals to reframe challenges as opportunities, thereby elevating both client outcomes and the overall success of the organisation. This goes beyond merely "bouncing back" from setbacks; it empowers bankers to thrive actively amidst adversity, grounded in a deeper, more intrinsic purpose. The consistent findings across diverse psychological research – from Frankl's emphasis on meaning to Bandura's work on self-efficacy, Csikszentmihalyi's insights into flow, and Dweck's contributions on growth mindset – collectively demonstrate that these psychological resources are not static traits but are cultivable and directly contribute to an individual's capacity for enduring resilience.

For organisational development, the implications are clear: to cultivate robust sales resilience, financial institutions must move beyond superficial training modules and instead invest in fostering a deep, pervasive sense of personal significance within their workforce. This necessitates a holistic approach that encompasses not only targeted skill development but also deliberate mindset shifts, the cultural reinforcement of purpose and individual agency, and the strategic creation of work environments that naturally facilitate optimal engagement.

The comprehensive nature of this analysis reveals that fostering resilience is not solely an individual responsibility but rather a holistic organisational competency. The emphasis on proactive, value-based client engagement implies a strategic focus on long-term client relationships. When personal significance drives resilience, and resilience leads to sustained performance and reduced burnout, the investment in these psychological foundations yields a significant long-term return.

Read the Complete Research Paper with Full References →

This research was conducted by Dr. Cliff Brunette and Leila Shirley, examining the strategic role of personal significance in building enduring sales resilience in the financial services sector. All citations and detailed references are available in the complete paper.

0 Comments